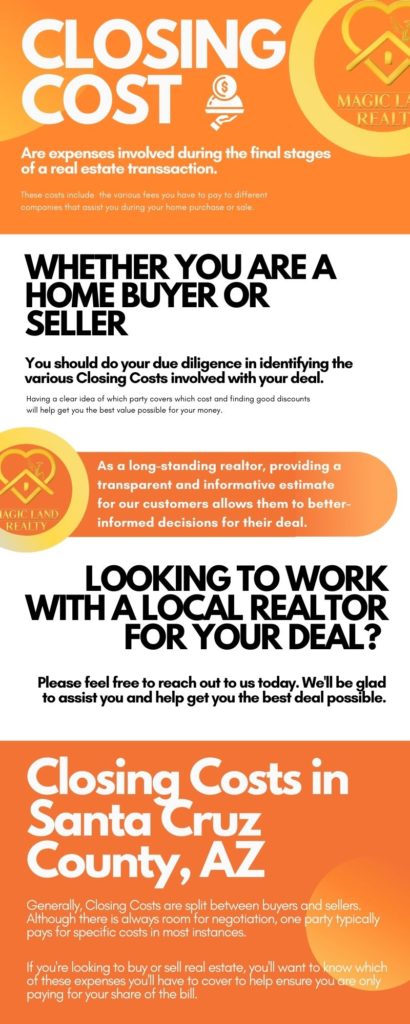

Closing Costs

Closing Costs are expenses involved during the final stages of a real estate transaction. These costs include the various fees you have to pay to different companies that assist you during your home purchase or sale.

Whether you’re a home buyer or seller, you should do your due diligence in identifying the various Closing Costs involved with your deal. Having a clear idea of which party covers which cost and finding good discounts will help get you the best value possible for your money.

As a long-standing realtor, we provide a detailed consultation to our clients to ensure they know the various costs involved with a transaction. Providing a transparent and informative estimate for our customers allows them to better-informed decisions for their deal.

If you’re looking to work with a local realtor for your deal, please feel free to reach out to us today. We’ll be glad to assist you and help get you the best deal possible.

Closing Costs in Santa Cruz County, AZ

Generally, Closing Costs in Santa Cruz County, AZ are split between buyers and sellers. Although there is always room for negotiation, one party typically pays for specific costs in most instances. If you’re looking to buy or sell real estate, you’ll want to know which of these expenses you’ll have to cover to help ensure you are only paying for your share of the bill.

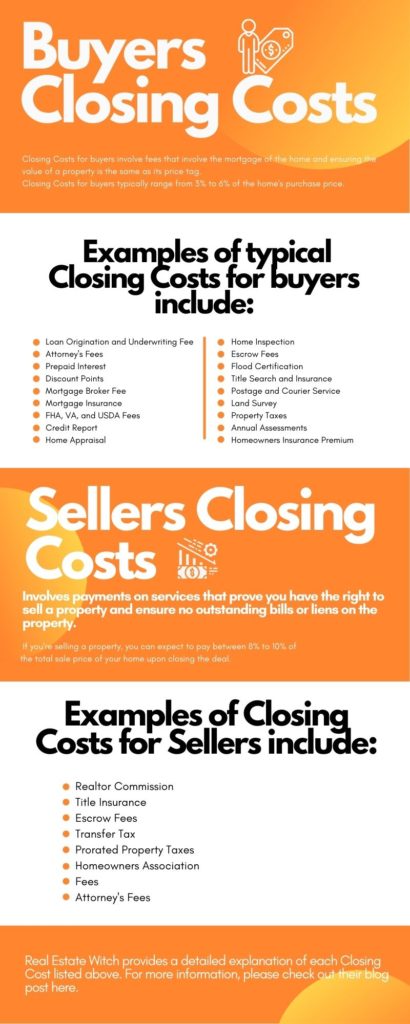

Buyers Closing Costs

Closing Costs for buyers usually involve fees that involve the mortgage of the home and ensuring the value of a property is the same as its price tag. Closing Costs for buyers typically range from 3% to 6% of the home’s purchase price. Examples of typical Closing Costs for buyers include:

- Loan Origination and

- Underwriting Fee

- Attorney’s Fees

- Prepaid Interest

- Discount Points

- Mortgage Broker Fee

- Mortgage Insurance

- FHA, VA, and USDA Fees

- Credit Report

- Home Appraisal

- Home Inspection

- Escrow Fees

- Flood Certification

- Title Search and

- Insurance

- Postage and Courier Service

- Land Survey

- Property Taxes

- Annual Assessments

- Homeowners Insurance Premium

For a detailed explanation of the charges you see on this list, Nerdwallet offers a comprehensive description of each item.

Sellers Closing Costs

Sellers Closing Costs involve payments on services that prove you have the right to sell a property and ensure no outstanding bills or liens on the property. If you’re selling a property, you can expect to pay between 8% to 10% of the total sale price of your home upon closing the deal. Examples of Closing Costs for Sellers include:

Realtor Commission

Title Insurance

Escrow Fees

Transfer Tax

Prorated Property Taxes

Homeowners Association Fees

Attorney’s Fees

Real Estate Witch provides a detailed explanation of each Closing Cost listed above. For more information, please check out their blog post here.

Ways to Save on Closing Costs

There are various ways you can save on your Closing Costs, and you’ll want to talk to your realtor if some of these examples are doable in your particular situation. If you’re willing to invest the time, you can save a significant amount from your total bill if you do the extra legwork and follow our 5 Ways on Saving Money from your Closing Costs.

To learn more about ways you can Save Money on Closing Costs, check out this article from Forbes.

If you’re planning to get a mortgage for your home purchase, then you’ll surely want to talk to multiple lenders in your area. Home loans are a competitive business, and most lending companies offer various discounts to help close the deal. Let each lending company know you’re talking to their competitors and help encourage them to provide better offers to get your business. You’re sure to get a better deal if you speak to several companies than just talking to one mortgage provider.

You do want to put a limit on the number of lending companies you talk to, though, as each of them will probably run a credit check when providing an offer. If you have several credit checks done simultaneously, it will likely lower your credit score, which could be bad for your home loan.

A GFE or Good Faith Estimate is an itemized breakdown of the various fees involved in a mortgage deal. If you plan to finance your home purchase, you’ll want to ask for a GFE from all the lenders you’ll be talking to.

Make sure to spend time reading the estimates provided by your lenders and have them explain any items you’re not familiar with. If some of the charges can be removed or discounted, you’ll also want to ask them before leaving their office.

Closing at the end of the month will help save you some money on your daily interest charges from your mortgage. Have your lender run a simulated estimate on the amount of money you can save if you close the deal during this time.

If you’ve got good leverage on the seller or buyer or need a slight discount to close the deal, you can try to appeal to your counterpart to cover part or all of the closing costs. Depending on your situation, negotiating can help get you a good deal on your Closing Costs which may be significant savings for you upon closing your sale.

Closing Costs are unavoidable, but taking proactive steps by asking for discounts and negotiating prices can help get better deals than what you would typically get. Whether you’re getting an appraisal on your property or having your attorney look at your papers, asking for discounts in a respectful manner is never going to be a bad thing.

Final Thoughts

Closing Costs are a standard part of any real estate transaction. Buying or selling a home is a significant financial decision, and you want to make sure you have as much information on your deal as possible. Learning about these Closing Costs will help ensure you are better prepared when you make your final decision.

Should you have more questions you would like to ask about Closing Costs in Santa Cruz, Arizona, please don’t hesitate to reach out to me today.